If you’re picking up the reigns of starting a business itself can be quite overwhelming, but taking it online can feel like you are sometimes stuck in the loop, given that you have to take it online at one point. Of course, taking it online might be easier than starting a brand new business, but what if you are new to eCommerce? Settled to sell your products and services through WooCommerce, then you got to face the elephant in the room “Which payment gateway should you choose for your business?

The payment gateway you choose may have a long-term effect on the growth and sustainability of your business. However, it is challenging to pick up the right payment gateway for your enterprise, with so many options available in the market.

Now it might get rather confusing once you dive into the rabbit hole of how the gateway works, its interface, whether its functionality is easy for the customers, would these built-in features be useful for my store, pricing rates, and the list goes on and on. So that’s why we have walked through that lane for you and picked out the ideal payment gateways that might fit your business needs.

Payment gateway: The fundamentals

A payment gateway is a technology that allows eCommerce merchants to accept credit or debit payments from their consumers. The technology is like a point of sale (POS) at a brick-and-mortar store but for an online store. Now payment gateway charges are small amounts, and through a customer’s eyes, it might not seem much, but when it comes to a business, these charges significantly impact the profits levels.

Opting for a third-party payment gateway has its perks, you can safely complete transactions and skip the hurdles of going through the financial and legal hassle of processing each transaction on your own. Two factors determine the charges set by the payment gateway, one is a certain percentage of an online payment amount, and the second is the online payment method used by the shopper. In addition, a payment gateway can easily manage your consumer’s data, like their credit card number, expiration date, and other vital data, so you don’t have to stress about it.

So if you are a WooCommerce seller, note that setting a payment gateway for running an online store is indispensable. As the processing gateway can give you the flexibility and reach that a traditional transaction can’t provide. It can aid you in managing all the payments with several operations like real-time banking, instant refunds, and more.

How does the payment gateway work, and how to open one?

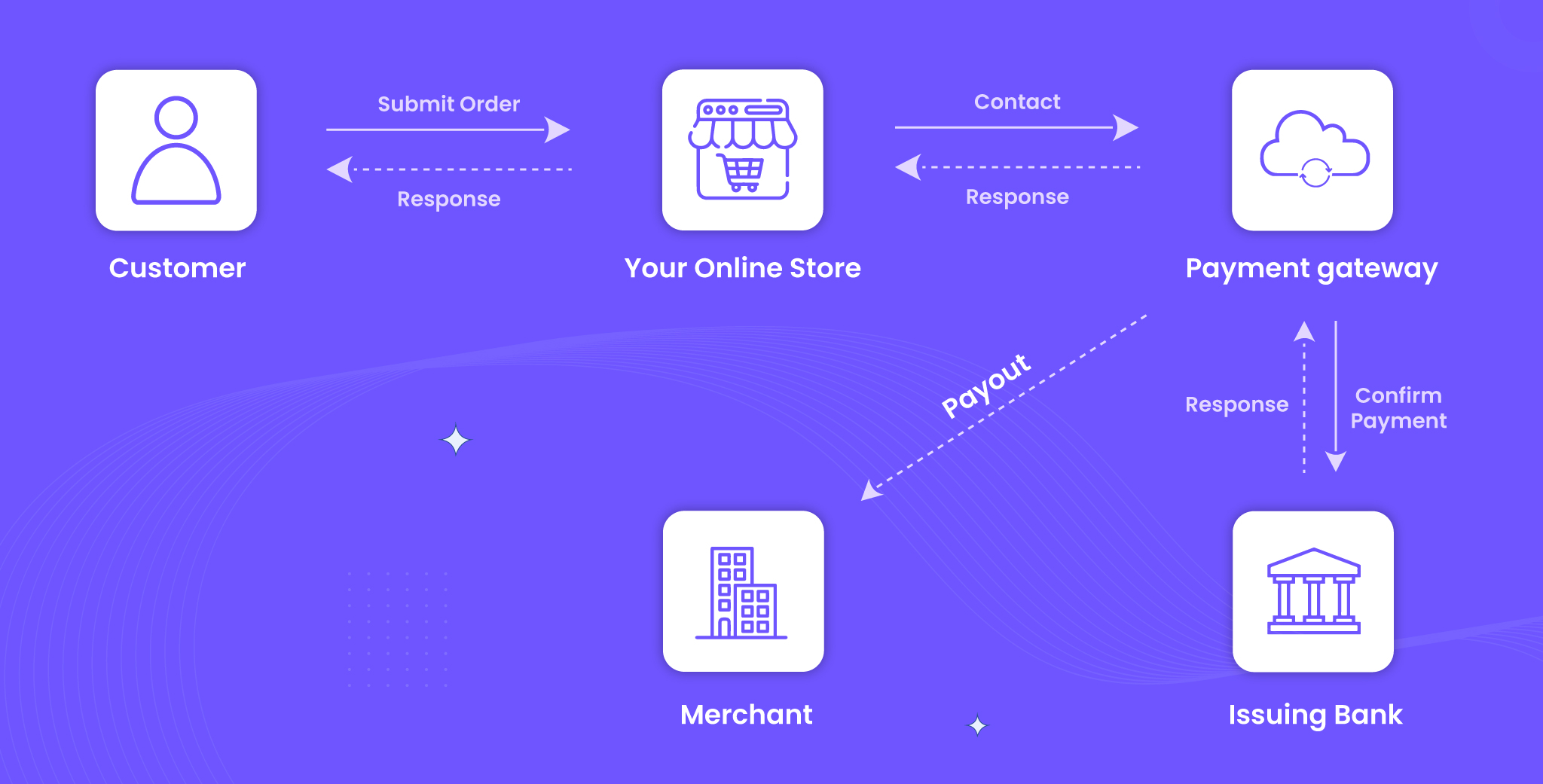

A payment gateway executes several necessary operations like receiving, process, verifying, encrypting, and transferring transactions from a buyer to the store owner.

The customer begins the process of completing a purchase once the customer’s card details are shared inside the portal. First, the payment gateway verifies the customer’s payment information and checks if the account holder has sufficient funds. Then the gateway transfers the encrypted data to the card network. The store owner will be notified of the transaction status once approved. The final step is that the payment gateway will direct the buyer issuing bank to transfer funds to the store owner’s account.

Now setting it up is relatively easy.

- You can start by creating an account through one of the below-given payment gateways.

- Then, connect your business bank account with the payment gateway account.

- Next, link the payment gateway to your WordPress website. Major third-party payment gateways like Stripe or autorize.net offer plugins through which you can quickly connect to WooCommerce.

You are now all set to accept transactions from your customers. Once the customer makes a transaction, you will be notified, and most of the time, the duration to receive the payment will depend on the gateway. Either the payment will be credited quickly or within a few days.

Aspects to consider while choosing a payment gateway that works for WooCommerce?

Do remember the main reason you choose a payment gateway is to give your customers an exceptional and easy transaction experience, enrich your business profile by satisfying your customer’s needs, enable quick transactions, etc. To ensure all your needs are met, it is essential to analyze each option available to you carefully. Here are a few factors you should look out for when choosing the right gateway for your WooCommerce store.

Compatibility with WooCommerce

Want to simplify the whole process of configuring a payment gateway?

Go for a payment gateways that already has a WordPress plugin, this can ensure and simplifies the process of integrating the gateway into your site. Certain payment gateways providers come with gateway plugins, which can solve the difficulty of manually setting up the gateway. WordPress and WooCommerce accept all major payment gateway systems, so most of the time, you will be able to find the right gateway. But it is ideal for checking if the gateway is easily compatible with your website.

Transaction fee

Every single gateway has different transaction fees, and these charges are typically imposed on the customer based on the purchase made and the payment method used. Therefore, when considering a payment gateway, you should first evaluate aspects like how much charges a payment gateway provider could charge for handling your store’s overall payment process.

The two components of a transaction fee are the percentage of transactions and a small fee charged for each transaction. The percentage of transactions usually comes around 1.5% to 3.5%, and the small fixed charges are mostly up to $0.30. These charges may look insignificant, but even a slight change can significantly impact any business. Therefore, we suggest that you go for a payment gateway that is cost-effective and convenient.

Operational cost

The payment gateway does other have other charges apart from the transaction fee. Most gateway charges include monthly fees, additional charges depending on the type of transaction, and other fees. Picking up a service based on your business requirements is vital. So in simple terms, if you have international consumers, it would be highly lucrative to choose a gateway provider that charges low global payment processing fees.

Security

The top priority for any store owner is to protect their customers’ data and transaction information. Relying on an undependable service can leave your business and customer at constant risk of legal, technical, and financial problems. Consequently, while selecting a payment gateway, it is important to check the anti-fraud detection program and digital security measures that the service provides.

Thankfully, nowadays, payment gateways come with a fraud protection system that can aid you just in case unauthorized transactions are bound to occur.

Support in your country

Unfortunately, the payment gateways are often geographically limited as it falls under strict financial and legal regulations. The availability of payment gateway options for WooCommerce in a particular country may vary. Some popular payment gateways available in many countries include PayPal, Stripe, and Square. It is recommended to check with the specific payment gateway provider to confirm their availability in your country. It is also possible to use local payment gateways specific to your country, such as Paytm in India or Alipay in China.

Simple user interface

Now opening and running a business itself takes a lot of work. To make things as easy as possible, developers usually seek out payment gateways designed with simplicity in mind. Having a clean and straightforward interface that is easier for the user to navigate is ideal. Users need to select their preferred payment method and enter their payment details to make a payment. The payment gateway will then process the payment and send a confirmation to the user. Users can also manage their payments and view their transaction history within the payment gateway. This includes viewing past transactions, canceling or refunding payments, and managing recurring payments.

Payment method available for the consumer

Some payment gateway will restrict their consumers to use only credit cards or debit cards while other gateways allow completing the transaction through other methods.

Here are some of the most common options include:

- Credit and debit cards: Customers can use their credit or debit cards to make payments directly on the WooCommerce website. This is typically done using a payment gateway like Stripe or PayPal.

- Bank transfers: Customers can make payments by transferring funds directly from their bank account to the WooCommerce store’s bank account. This is a standard option in countries where credit and debit cards are not widely used.

- Cash on delivery: Customers can choose to pay with cash when the order is delivered to them. This is a popular option in some countries, especially for large or expensive purchases.

- Other options: There are many other payment methods that may be available on a WooCommerce store, depending on the location and needs of the business. Some examples include gift cards, digital wallets, and cryptocurrency.

Currency

The user’s location and preferences determine the currency that works for WooCommerce. WooCommerce allows users to set their store’s currency in the general settings section of the dashboard. From there, users can choose from a list of available currencies, including the US Dollar, Euro, British Pound, and many others. Once the currency is set, all prices displayed in the store could be in the chosen currency. WooCommerce also allows users to set up multiple currencies and display prices in multiple currencies in the same store. This is useful for stores that sell to customers in different countries and regions with different currencies.

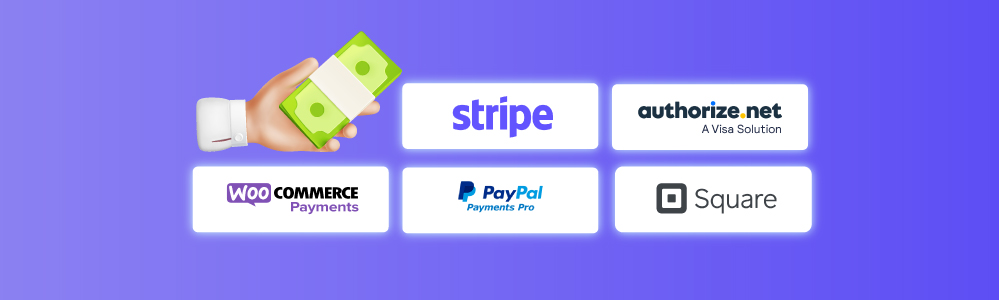

Top 5 Payment Gateways for WooCommerce

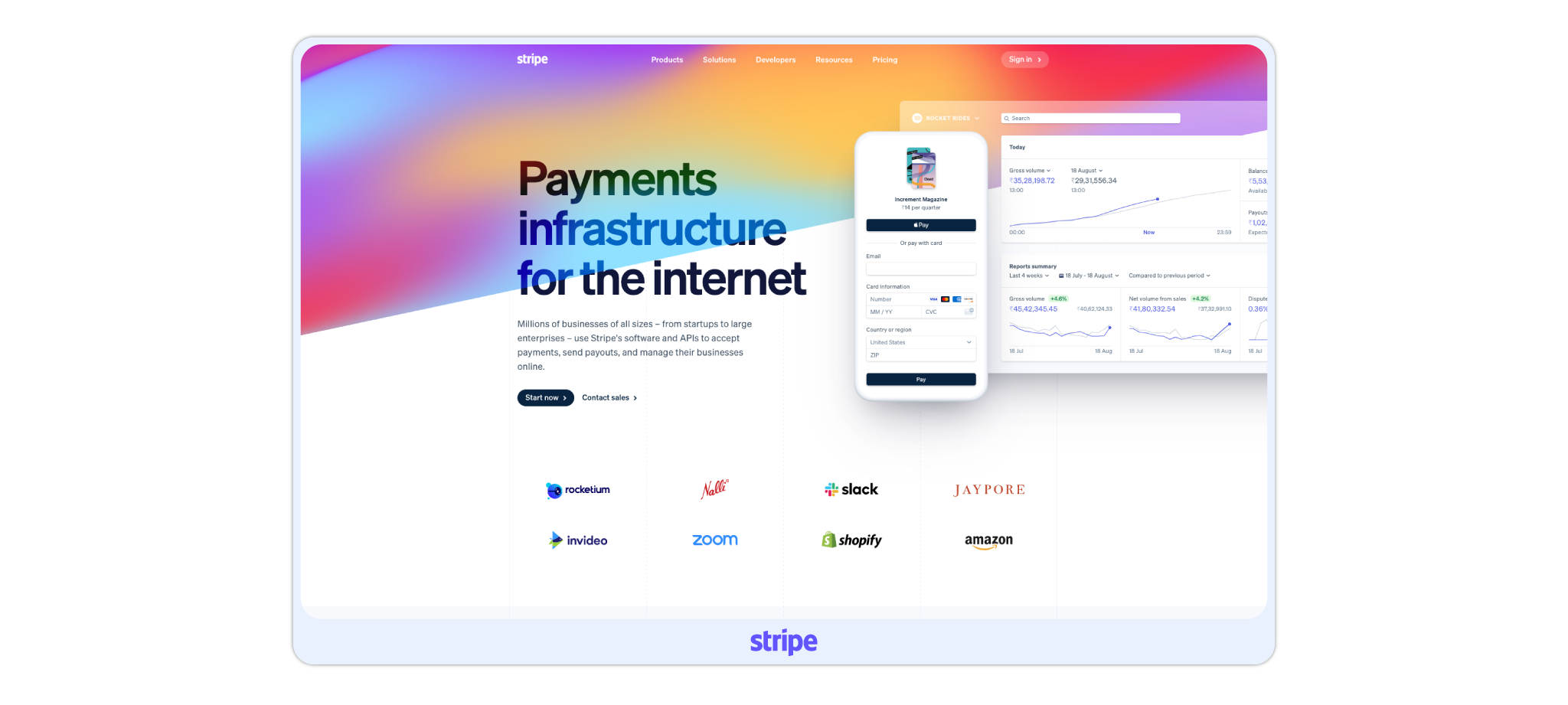

Stripe

Stripe, launched in 2011, is the closest alternative to PayPal, an American-Irish payment plugin used by millions of customers worldwide. They have a paramount business strategy in which they offer both APIs and payment processing plugins to their online customers. Clean design, ease of use, developer-friendly documentation, and setup are a few of the key reasons why it is still preferable to merchants.

Stripe offers some exceptional dashboard features like transaction history, integration monitoring, and categorized monthly totals. The payment gateway is highly compatible with WooCommerce you could easily integrate it into your WordPress site. The Stripe extension for WooCommerce is free, and the transaction charges per purchase are relatively low. PCI compliance optimized in the form makes sure that the payment made by the consumer reaches the merchant safely. Popular businesses like Shopify, slack, GitHub, amazon, Kickstarter, etc have opted for Stripe as their payment partner.

Prominent features

- Stripe has around 12+ payment methods that the customer can avail

- Invoices

- Customizable payment forms

- Contains embeddable checkout

- WooCommerce Plugin is available, making it easy for integration and configuration.

- Customizable design

- Financial reporting

- PCI Compliance

- Flexible and Transparent Pricing

Pros

- It has developer-friendly documentation and features

- The pricing is based on industry standards

- Excellent Customer Support team

Cons

- Stripe has geographical limitations, so it is not accessible in all countries.

Fees

- The pricing rates of Stripe go like this, 2.9% of every transaction and an additional $0.30 per card charge.

- 1% extra on international charges and 1% extra if the currency changes are required

- Now, when it comes to setup charges are none and no monthly/ yearly fees

- It has a pay-as-you-go pricing method

Takeaway

- Stripe is an excellent payment gateway that is available in the current market, particularly for those who are comfortable with coding.

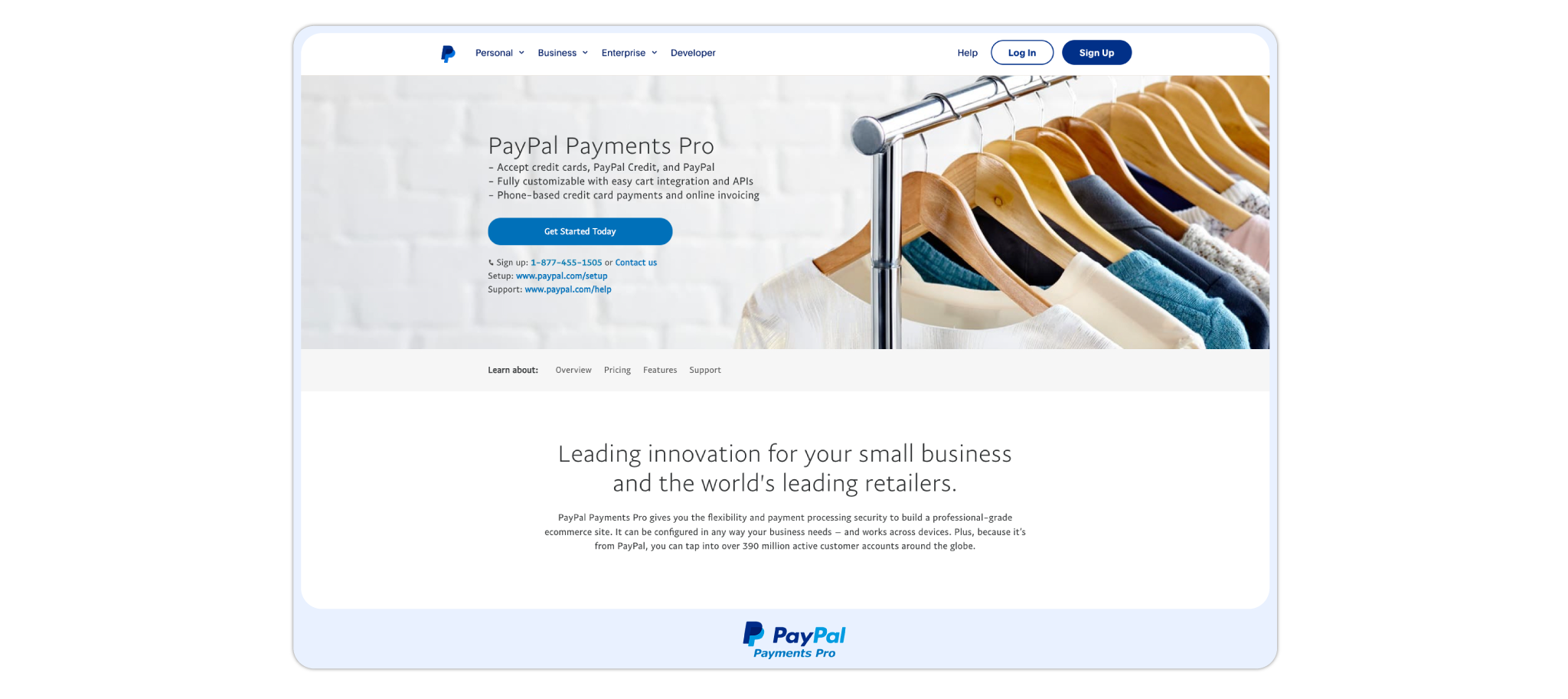

Paypal pro

PayPal is one of the first payment gateways to be introduced first on the internet. It’s a complete solution that accepts credit and debit cards on your WooCommerce store. Even though most of us are aware of PayPal, being it the oldest and most widely used payment gateway, they have a business solution called PayPal Pro. Paypal Pro offers a convenient solution for users by giving them an internet merchant account and a payment gateway all in one place. This can help you avoid the hassle and clutter of expenses by multiple payment providers. Now PayPal Pro does offer a WooCommerce plugin for the WooCommerce store owners, which makes its configuration to the site rather effortless. The main aspect of PayPal is that it has no set-up cost or monthly charges, making it ideal for business owners starting their businesses.

Prominent Features

- APIs that are Customisable

- Tax calculator

- Professional Email Invoices

- On-Site Credit Card checkout

- Offer Later Pay options that could easily convert visitors to customers.

- Effortless Transaction Process

- WooCommerce Plugin is available

- Paypal offers 24/7 fraud detection and monitoring tools.

Pros

- It is a popular payment gateway that is familiar to vendors and customers.

- Easy to use and set up

- It is accessible in most countries around the world.

Cons

- Have monthly fees

- Not developer friendly

- Lacks in personalization

Charges

- Paypal Pro’s charges are based on the location and the type of transactions.

- The basic charge per online transaction is 2.9%, and an additional charge of 1.5% for international transactions.

- PayPal Pro does have a monthly plan that charges $30 to their users.

Takeaway

- If you rush to set up your WooCommerce store quickly, the answer is PayPal pro, as it is a preferred and default gateway opted by eCommerce.

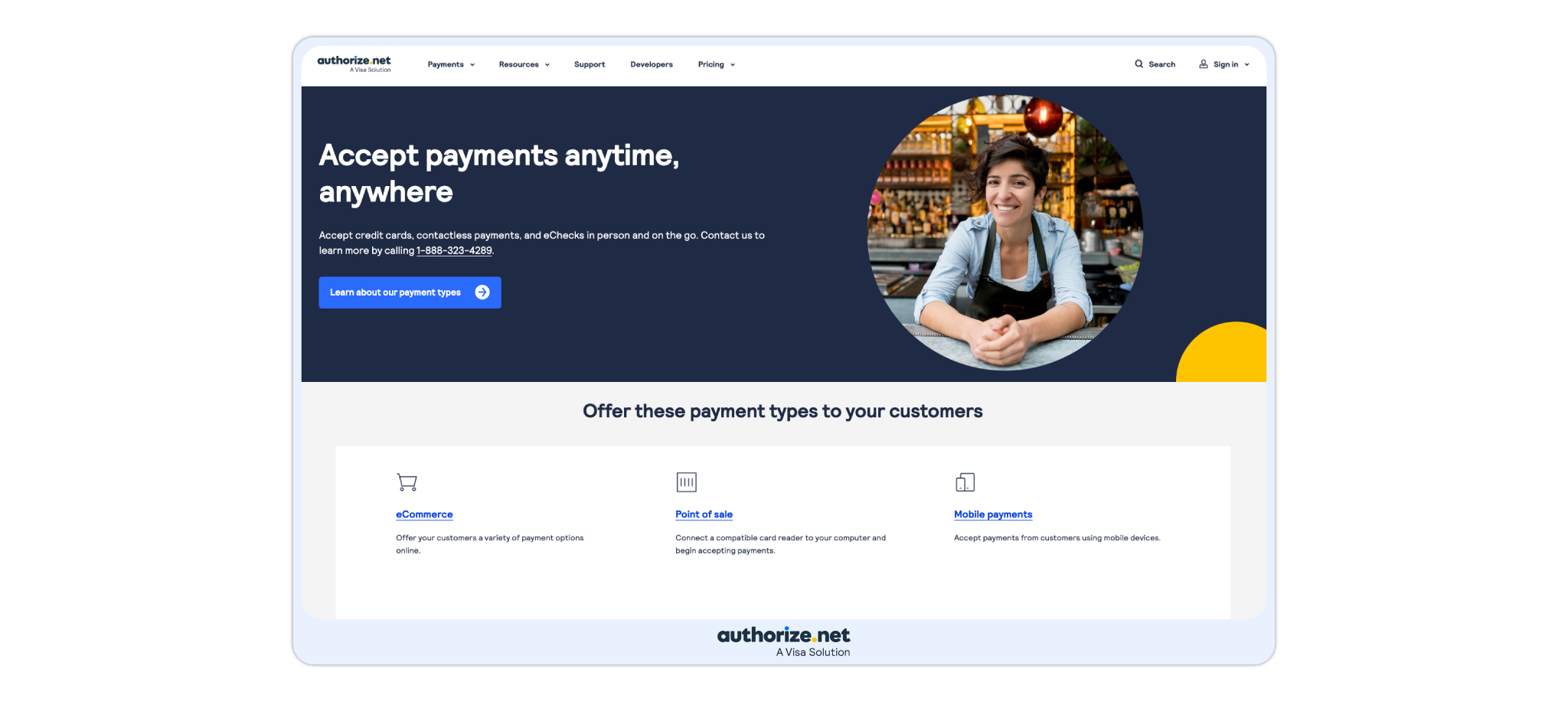

Authorize.net

Authorize.net is a visa solution for WooCommerce that offers tools you need to process payments. It is a popular choice among many businesses as it boasts many unique features. Now, as all payment gateway, it can handle major credit and debit cards, and at the same time, autorize.net can also handle refunds, subscriptions, and pre-orders. Clients can also have options to save their payment details in order to simplify the transaction process during the next purchase, and it would remain secure.

This Payment gateway service is an ideal solution for enterprises with large monthly sales. Furthermore, Authourize.net has a plugin that is compatible with WooCommerce Subscriptions and pre-orders. Finally, what makes business owners prefer authorize.net is that it can allow a customer to finish the entire checkout process on their own WordPress site and make it flawless, lessening the chance of cart abandonment by potential customers.

Prominent Features

- Highly Advanced fraud detection and prevention

- Recurring payments

- PCI compliance and SSL certificate installation are mandated

- Easy-to-use checkout options

- Good Support team

- Global consumer base

Pros

- Backed By Visa

- Comprehensive reporting feature

- Affordable charges, even for high transaction volumes

Cons

- Only available to conduct business in the USA and Canada

- Hard to setup

- Not ideal for small enterprises

Pricing

- Authorize.net charges an installation fee of $49 and a monthly fee of $25. But they do have a per transaction fee, which is 2.9% + 30¢ per transaction.

Takeaway

- Authorize. Net is an excellent choice for large and serious businesses. To a beginner, it might be too sophisticated and hard to handle.

Square

Square is a complete gateway for WooCommerce that provides you with an online payment portal, an in-person payment service, and a money manager. The major benefit of opting for square is that it is a platform that can be used by both offline and online merchants alike. They have set up features like appointment scheduling, social media marketing, and standard POS that traditional offline stores can avail of. With the WooCommerce integration plugin, you can accept payment in person or online, which makes it easier for both consumers and business owners.

Square is quite a user-friendly payment gateway for merchants, as it is easy to install and doesn’t require prior coding skills. The service is created keeping in mind it should be simple so that everyone can use it with ease, specifically for offline merchants. Square has included tons of options like shipping, tracking, in-person pickup, and other business needs.

Prominent Features

- WooCommerce Plugin

- Accept online and in-person payments

- It can automatically sync with your in-person square device.

- Supports both delivery and in-store pickup system

- SEO Optimization and tools

- Professional Invoices

- Coupons

- It can be integrated with Instagram

- Scheduling system set for appointments

- Have multiple payment options like Gpay and Apple pay apart from credit and debit cards.

Pros

- Affordable

- A well-designed and simple user interface, even for an in-person transaction

Cons

- It’s only available in some countries.

- Currency conversion rates are high

- It is designed for an in-person than an online eCommerce store.

Pricing

- Square has a per transaction fee, which is 2.9% + 30¢ per transaction.

- Square offers pre-paid monthly plans that come with additional plans and other discounts.

Takeaway

- Square is a great payment plugin, for in-store entrepreneurs as it has a lot of features they can incorporate into their business.

WooCommerce Payments

WooCommerce Payments is considered one of the best options available for the e-commerce industry. Developed by WooCommerce, it is a payment gateway that has the strongest integration as it is tailor-made for WooCommerce, this provides a state-of-the-art checkout experience for each and every customer who uses it. The WooCommerce Payments pricing system is carried out with a pay-as-you-go fee structure and has no installation charges.

WooCommerce Payments have exceptional compatibility that WordPress supports. They provide a direct and fast transaction process to avoid abandonment carts. A customer can complete the entire checkout process on the merchant’s website. Now, if you are a WooCommerce user, this plugin is absolutely free what more could you ask for?

Prominent Features

- Strong integration makes it the most compatible with WooCommerce store

- No monthly subscription

- Have multiple integrations option

Pros

- It has a mobile app

- Compatible payment solution for consumers

Cons

- Complicated application process

- High transaction fees

Pricing

- They have pay as you go for pricing model, so there are no setup fees, monthly fees, or other hidden charges.

Takeaway

- WooCommerce Payments is similar to Stripe, but it is simpler and significantly easier to set up. It is Ideal for users that have large monthly sales.

Conclusion

Most of the time, if a person is shopping online, they prefer to complete a transaction with a payment method they usually use. If the website’s payment gateway doesn’t support the payment method, this usually results in cart abandonment. The payment gateway you pick has quite a significant impact on your business.

We hope that this blog was useful to you in picking up an ideal payment gateway to use for your business. Yes, it can be quite stressful to pick the ideal choice from the vast category of choices available.

Every gateway has its own benefits and features, and some work impeccably with WooCommerce. The only difference is that some work better than others, depending on certain situations and factors.

THANK YOU!

THANK YOU!